Brighthouse SmartGuard PlusSM Interactive Tool

Use our interactive tool to see how Brighthouse SmartGuard Plus can help you protect loved ones and offer financial flexibility for the future.

SmartGuard Plus Tool Page URL

Link to the SmartGuard Plus Tool page: https://aem-qa2.brighthousefinancialpro.com/pro/test-adv-2-0/smartguard-plus-tool/

This tool requires a larger screen to display.

Increase the size of your browser window to interact with the tool. If you’re on a tablet, rotate to view horizontally (landscape orientation).

To quickly access the tool from a larger device, email yourself a link to this page.

Learn More

Brighthouse SmartGuard Plus can provide:

- Growth opportunities and a level of protection

- Guaranteed Distribution Payments1

- A guaranteed death benefit2

As an index-linked life insurance product, Brighthouse SmartGuard Plus tracks the performance of one or more market indices and does not invest directly in the markets. Once Distribution Payments begin, all policy values are transferred to the Fixed Account and there is no further participation in index-linked market performance.

View product details and access resources.

Get current rates for Brighthouse SmartGuard Plus.

View Brighthouse SmartGuard Plus prospectus.

Important Information About the GDR

Once Distribution Payments begin, all policy values are transferred to the Fixed Account and there is no further participation in index-linked market performance. Clients may choose their Distribution Payment amount, subject to the Maximum Distribution Payment amount, and can choose to stop receiving payments at any time.

Maximum Distribution Payment amounts not taken in full, or at all, after the Distribution Start Date are payable as a One-Time Payment, which is separate from scheduled Distribution Payments. A One-Time Payment can only be elected once and cannot exceed the lesser of $150,000 or three times the Maximum Distribution Payment.

Distribution Payments and One-Time Payments are paid from the policy’s cash value and are in the form of policy loans. Upon payment, the Fixed Account cash value is reduced by the amount of the loan, which is transferred to the Loan Account. The GDR will increase the policy’s cash value as necessary to prevent these loans from causing the policy to lapse.

After the Distribution Start Date, if clients take policy loans in excess of the amount available as a Maximum Distribution Payment or One-Time Payment, the GDR will terminate. When the GDR has terminated, the policy’s cash value will no longer receive any increase from the GDR and, without repayment of outstanding loans, the policy may lapse. Loan balances are charged interest at a rate of no more than 8% annually.

1 Available after the 10th policy year, Distribution Payments under the Guaranteed Distribution Rider (GDR) are in the form of policy loans and can significantly reduce the unloaned cash value and death benefit amount. When the cash value reaches zero, the GDR will continue to support the availability of Distribution Payments. See the prospectus for more details. A policy loan is generally not treated as a taxable distribution, but exceptions may apply. Consult with a tax professional.

2 Policy loans may significantly reduce the death benefit; however, the GDR guarantees a minimum death benefit amount, assuming the policy and GDR remain in force. While the death benefit is generally income tax free, exceptions may apply. Other taxes including estate, gift, or generation-skipping transfer taxes may also apply. Consult with a tax professional.

Distribution Payments under the Guaranteed Distribution Rider are made in the form of policy loans. A policy loan is generally not treated as a taxable distribution if the policy is not a modified endowment contract (MEC) as defined under Internal Revenue Code Section 7702A and the policy remains in force during the lifetime of the insured. As a result, the company generally does not intend to report the benefits payable under the GDR to the IRS as taxable income based upon our current understanding of applicable tax law. Taxation and tax reporting may apply if the policy lapses, is surrendered, or becomes a MEC. The tax law is complex and subject to change. The company’s tax reporting position may change in the future due to future IRS guidance as well as any clarifications or changes to applicable tax law. The company cannot guarantee particular tax results. Any discussion of taxes is for general informational purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax, or accounting advice. Clients should confer with their qualified legal, tax, and accounting professionals to determine the tax consequences of the GDR and the policy.

This material must be preceded or accompanied by a prospectus for Brighthouse SmartGuard Plus, issued by Brighthouse Life Insurance Company, which contains information about the policy’s features, risks, charges, and expenses. Clients should read the prospectus, which is available from their financial professional, and consider its information carefully before investing. Brighthouse Financial has the right to substitute an index prior to the end of a term if an index is discontinued or we determine that our use of such index should be discontinued.

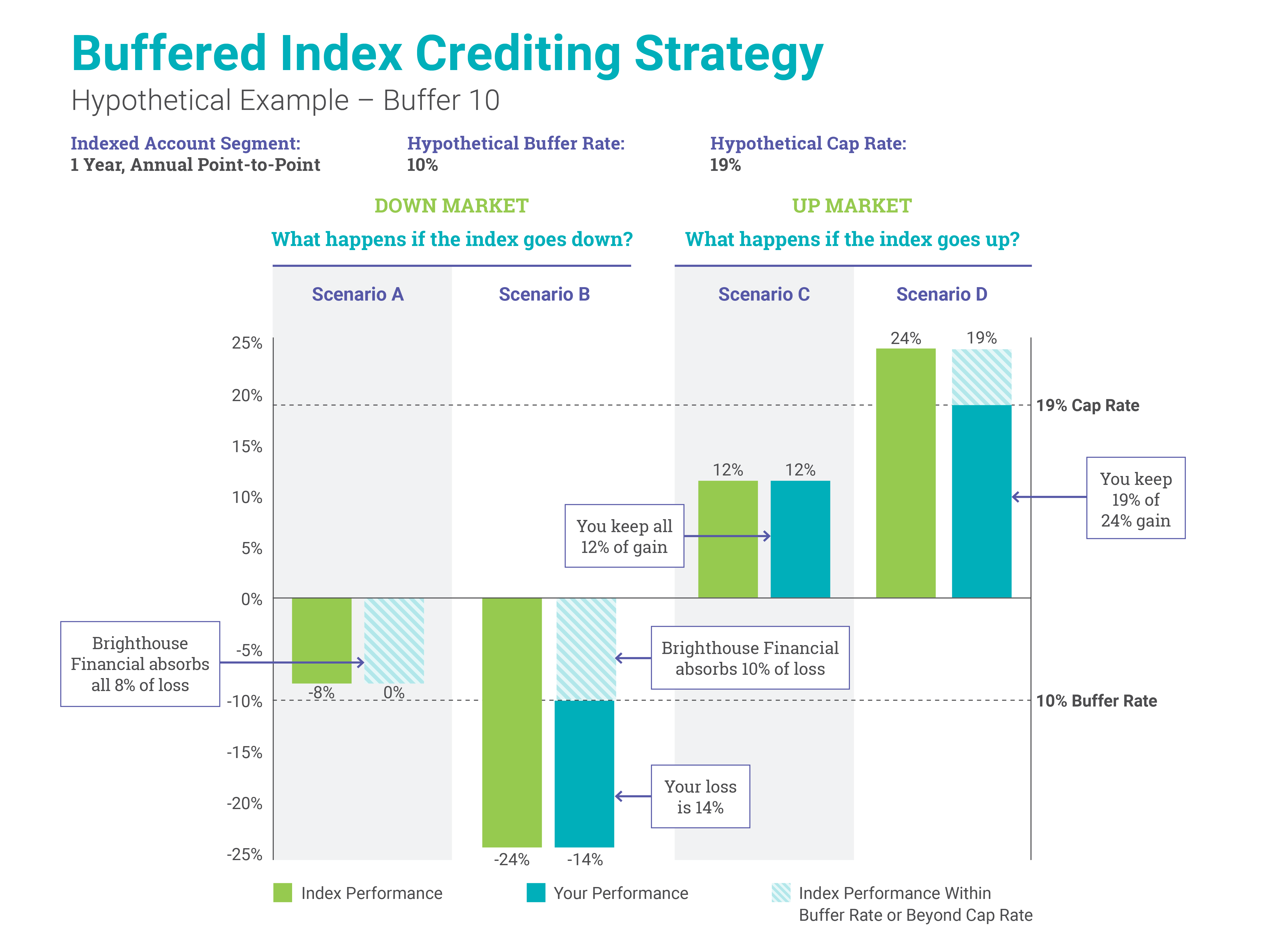

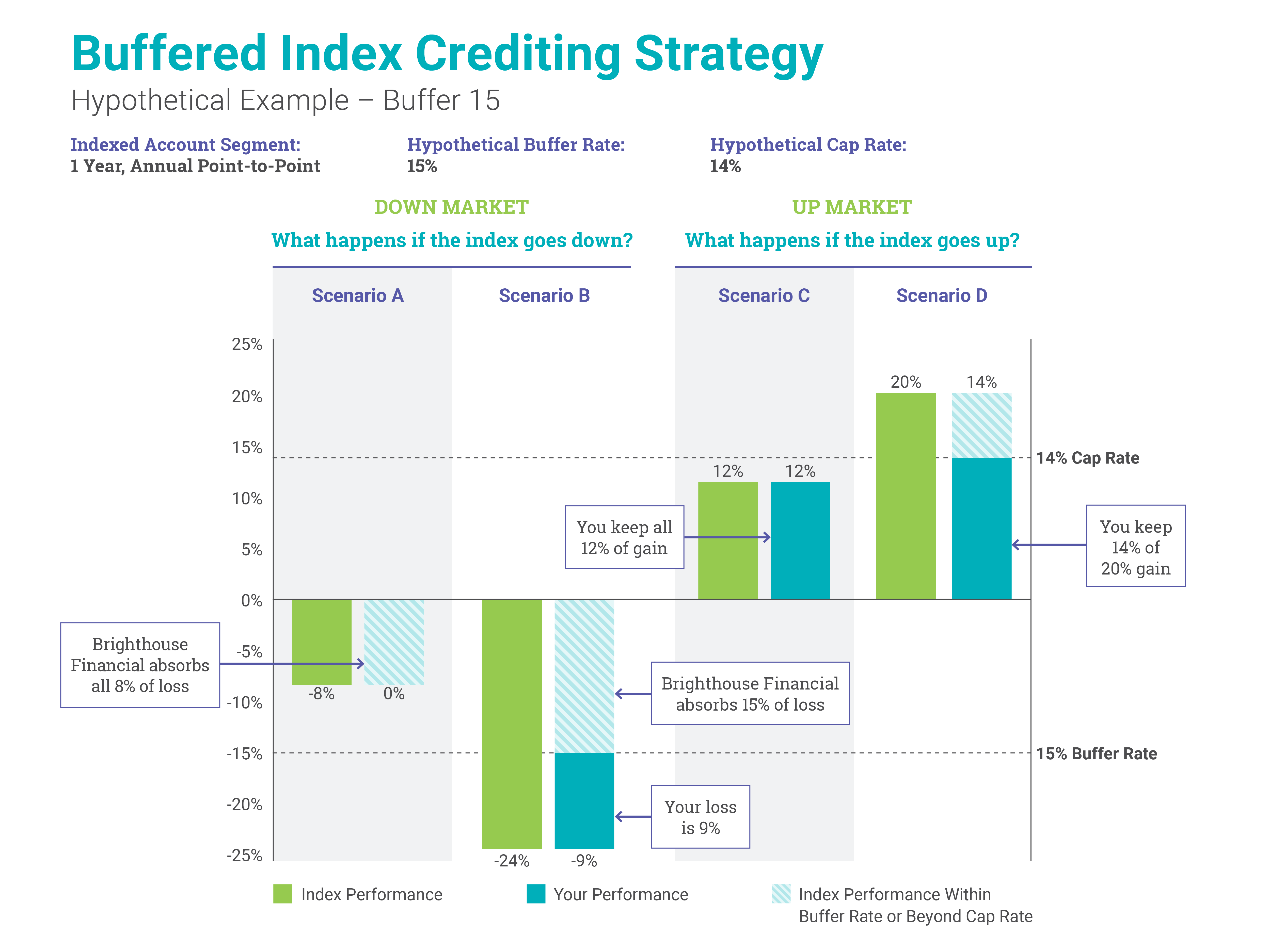

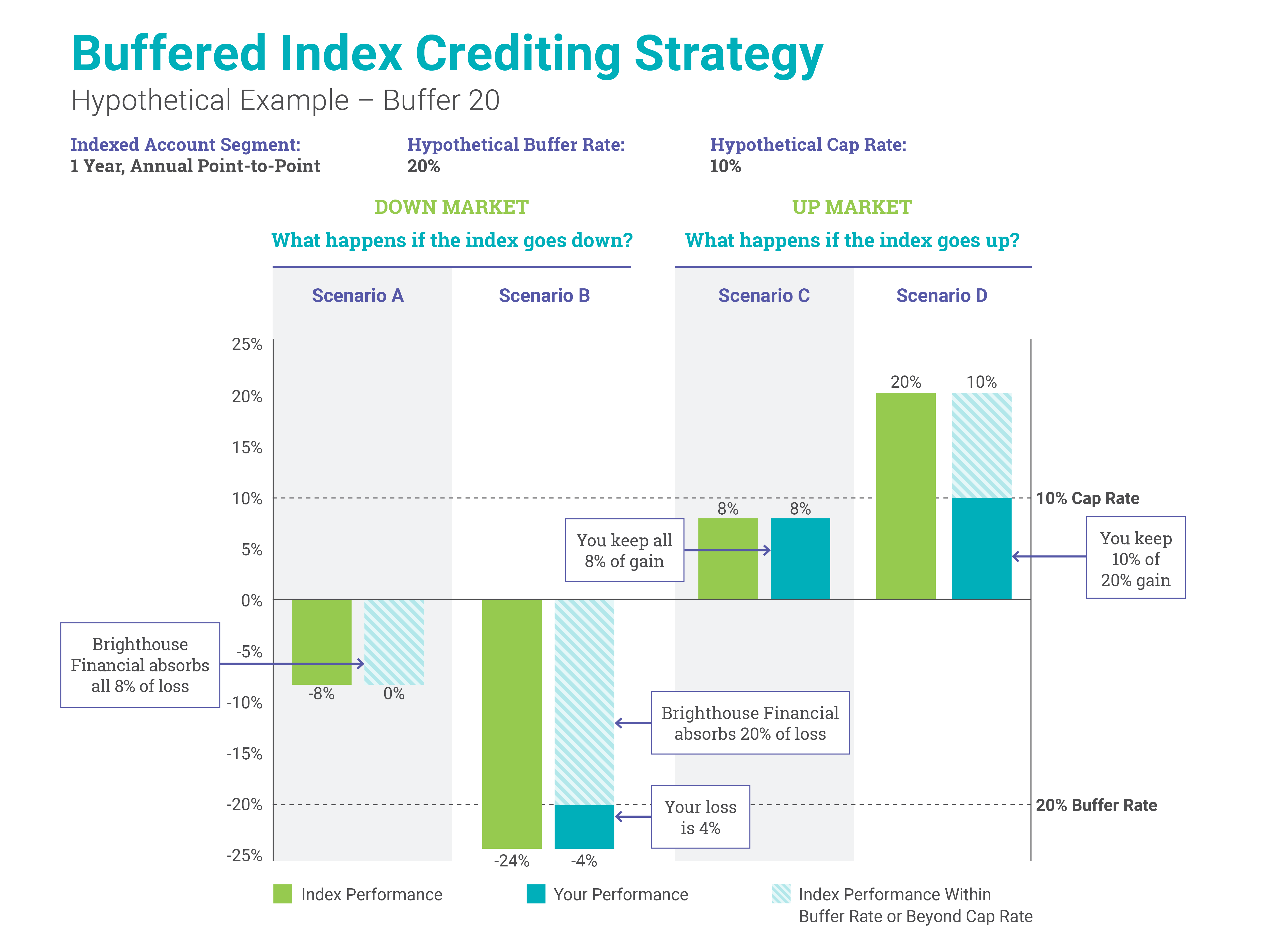

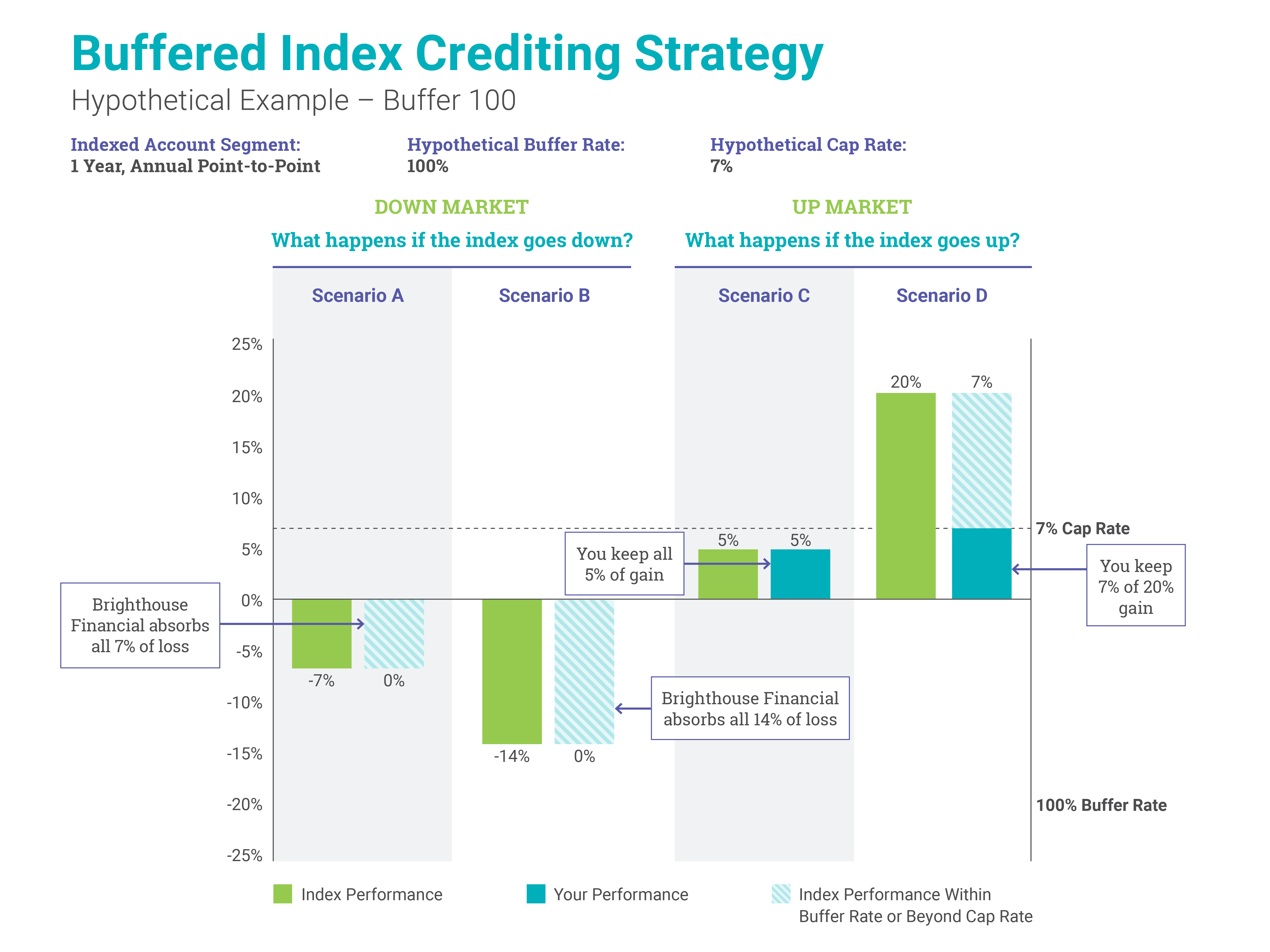

Brighthouse SmartGuard Plus has limitations, exclusions, charges, termination provisions, and terms for keeping it in force, and is not guaranteed by the broker/dealer, the insurance agency, the underwriter, or any affiliates of those entities from which they were purchased. All representations and policy guarantees, including the death benefit and guaranteed Distribution Payments provided by the Guaranteed Distribution Rider, are subject to the claims-paying ability and financial strength of the issuing insurance company. Because the client agrees to absorb all losses beyond their chosen Buffer Rate, there is a risk of substantial loss of principal. Please refer to “Risk Factors” in the prospectus for more details.

Brighthouse Life Insurance Company (BLIC) holds any net premium amounts applied to an Indexed Account in a Separate Account. BLIC maintains assets in the Separate Account at least equal to the policy’s required reserves, which equals the policy reserves associated with the Indexed Accounts. Required reserves do not include reserves held in the Fixed Account, reserves for outstanding loans, or reserves associated with Distribution Payments or One-Time Payments. BLIC is obligated to pay all money owed under the policy, including policy proceeds and Distribution Payments, even if that amount exceeds the assets in the Separate Account. Any such amount that exceeds the assets in the Separate Account is paid from the BLIC General Account. Amounts paid from the General Account are subject to the financial strength and claims-paying ability of BLIC and are not guaranteed by any other party.

Brighthouse SmartGuard PlusSM is a registered index-linked flexible premium adjustable life insurance policy with a Guaranteed Distribution Rider (GDR) issued by, and product guarantees are solely the responsibility of, Brighthouse Life Insurance Company, Charlotte, NC 28277, on Policy Forms 5-71-22 and 5GDR-22 (“Brighthouse Financial”). This product is distributed by Brighthouse Securities, LLC (member FINRA). All are Brighthouse Financial affiliated companies. Product availability and features may vary by state or firm. This product is currently not available in New York.